costa rica income taxes

Residents pay Costa Rican income tax at relatively low rates on a scale of 1 to 25. Income from employment monthly of individuals is taxed up to 15.

Pin On Sistema Atv Ministerio De Hacienda Costa Rica

Other recent tax developments concern.

. From 5299000 9296 to 8840000 15508 15. A resident for tax purposes is anyone who spends more than 183 days including part days in Costa Rica in a year. Up to 2747000 CRC.

Employment income on a monthly basis of individuals is subject to a progressive tax of 15 as follows. This regulation is essential for the tax legislation of that country since under this law Costa Rican taxpayers will be subject to. For self-employed rates range from 10 to 25.

And it imposes a flat rate of 15 on that 85 eliminating the various tax rates under the old system. Corporation arrangement to avoid some tax liability there are a number of intricacies to the system that can help you achieve your business and investment goals more efficiently. Costa Ricas income tax.

Personalize Microsoft Edge with popular extensions like ad blockers and password management tools. Personal income taxes range from 0 to 25 depending on the amount earned net income. Up to 3628000 US6479 0.

Dividend and interest income are generally taxed at 15 while most capital gains are exempt from taxation. The maximum tax rate of 15 percent for employment income and 25 for self-employment and business income. There are 2 different types of.

It assumes that in all cases expenses total 15 of rental income so it imposes taxes only on the remaining 85. The tax year in Costa Rica is the fiscal year running from October 1 to September 30. The following figures refer to annual salaries.

Once registered then you have the obligation to file your income tax return and pay any income tax that is due. Income taxes in Costa Rica apply only if you generate an income from your Costa Rican business or. Costa Rica applies a sales tax of 13 may possibly be raised to 14 and a special consumption tax on selected items which ranges from 8 to 10.

To add extensions select Settings and more Extensions Get extensions from the Microsoft Store. However the law establishes special regulations for small companies whose gross income does not exceed 112170000 Costa Rican colones CRC. Review the latest income tax rates thresholds and personal allowances in Costa Rica which are used to calculate salary after tax when factoring in social security contributions pension contributions and other salary taxes in Costa Rica.

However it has been reformed throughout time being one of the last modifications made by the Public Finance Strengthening Law. Any individual employed in Costa Rica pays a monthly withholding tax rate based on his salary. Some call this the 1515 tax because you deduct 15 of rental income and pay 15 on the rest.

Review the 2020 Costa Rica income tax rates and thresholds to allow calculation of salary after tax in 2020 when factoring in health insurance contributions pension contributions and other salary taxes in Costa Rica. Executive Decree Number 43375-H published in the official gazette on 22 December 2021 updated the income tax sections referring to salary profits and tax credits. Paying Costa Rican Taxes.

The Costa Rican tax system is unlike any in the world. 6 rows Costa Rica income tax rates are progressive between 0-25. For individuals it ranges from 10 to 25.

One of the key negative outcomes of online data breaches is the theft of active usernamepassword combinations. The Costa Rican income tax rate varies based on what type of income you receive. 5418000 - 9038000 US16139 15 on band over US9675.

The tax reform law includes significant income tax law changes such as the introduction of rules on the taxation of capital gains and interest expense deduction limitations as well as rules addressing hybrid mismatch arrangements and anti-tax haven provisions. In excess of 323000 up to 485000 10. Choose a specific income tax year to see the Costa.

Corporations generating Costa Ricansourced income are generally subject to a 30 income tax. 3628000 - 5418000 US9675 10 on band over US6479. Costa Rica taxes your income according to the follow sliding scales.

Over 18113000 US32345 25 on all income. From 3549000 6227 to 5299000 9296 10. The Income Tax Law was introduced to the Costa Rican tax system in 1988 through Law No.

With areas like capital gains entirely exempt from taxes and mechanisms such as an SA. The income tax scheme is graduated meaning that those who earn more are placed into a higher tax bracket. TAXABLE INCOME CRC US TAX RATE.

These updated income tax brackets apply from 1 January 2022. Up to 3549000 per year US6227 Exempt. In Costa Rica income tax rates are progressive.

Income up to 323000 exempt. Basically anything that is income producing and therefore taxed at 30. Updated income tax brackets.

Tax Rate Taxable Income Threshold. Costa Rica Income Tax Rates and Personal Allowances. Income tax rates for both companies and individuals are calculated on a progressive scale depending on gross income.

When a property is purchased it must be transferred into the purchasers name. Costa Rica requires taxpayers to pay taxes on income earned within Costa Rica. 17 December 2018.

New tax reform legislation in Costa Rica was passed 4 December 2018. Costa Rican income tax is payable on any income that is generated in Costa Rica for residents or non-residents. 9038000 18113000 US32345 20 on band over US16139.

In case of legal entities income tax ranges from 10 to 30. Tax Year In Costa Rica And Tax Filing And Payment Rules. 30 for companies with gross income over CRC 112170000.

Every person working in Costa Rica must pay a monthly withholding tax based on his her salary. INCOME TAX 2018-2019. Unlike the United States and other countries large.

Corporate income is taxed at a 30 rate. For residents of Costa Rica salaries and self-employment. For this category the following rates apply.

The Costa Rican sales tax is. Corporate taxation ranges from 10 to 30 depending on the amount. Fees for filing personal income taxes start around 1000.

This is something to keep in mind if you are buying a vacation rental condohome. It is best to talk to your Costa Rican CPA or lawyer to be clear regarding the income-generating asset and your income tax obligations with a vacation rental property. Costa Rica Tax System Income Taxes.

7 rows Income taxes on individuals in Costa Rica are levied on local income irrespective of.

Inactive Companies Must File A Tax Return By March 15 2022 Costaricalaw Com

Costa Rica Rental Income Taxes Special Places Of Costa Rica

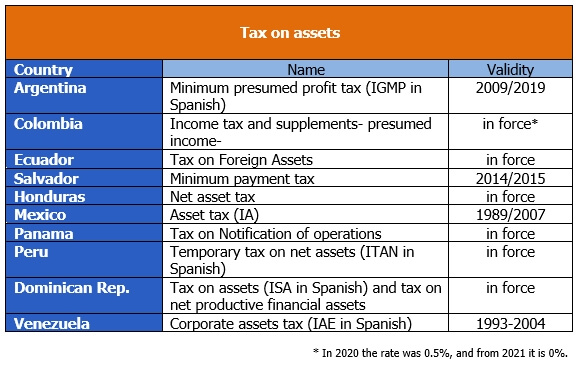

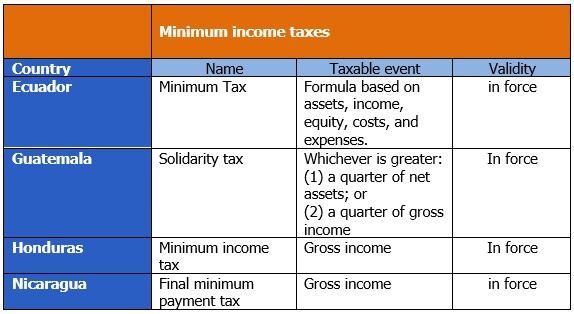

Income Tax Minimum Tax Inter American Center Of Tax Administrations

Honduras Personal Income Tax Rate 2021 Data 2022 Forecast 2004 2020 Historical

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

Tax Day In 2022 Tax Day Tax Income Tax

Income Tax Minimum Tax Inter American Center Of Tax Administrations

All About U S Tax When You Retire In Costa Rica Retiring In Costa Rica Costa Rica Real Estate Moving To Costa Rica

2022 What You Need To Know About The 13 Vat Tax In Costa Rica The Official Costa Rica Travel Blog

Costa Rica Company Filing Obligations For 2022 Costaricalaw Com

10 Tax Tips For U S Citizens Living In Costa Rica In 2021

Sources Of Us Tax Revenue By Tax Type 2022 Tax Foundation

Top 6 Countries For Day Traders Social Media Statistics Social Media Infographic Social Media Stats

![]()

Inactive Companies Must File A Tax Return By March 15 2022 Costaricalaw Com

Taxes In Costa Rica International Living Countries

Top 10 Tax Havens Around The World Tax Haven Income Tax World

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Dakota 5 Retirement Income Retirement Best Places To Retire

Costa Rican Taxes For U S Expats 8 Things To Know About Tax Returns